VT Munro Smart-Beta UK Fund

FUND OBJECTIVES

The Fund aims to maximise overall returns by seeking to replicate the performance of the Elston Smart-Beta UK Dividend Index. The Fund will invest mainly in large and medium sized companies, except investment trusts, that are listed on the London Stock Exchange. The Fund′s portfolio will be determined by investing most in those companies that are expected to make the larger dividend payments. For detailed information, please refer to the Key Investor Information Document.

WHY THIS FUND?

- The provides exposure to systematically-selected income-generative UK equities

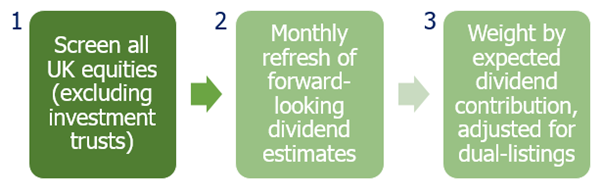

- The fund tracks an index whose security selection process captures changes in forecast dividends; weights holdings by forecast dividend contribution; and adjusts for dual-listings

- The fund pays out a monthly distribution to Income unitholders

HOW IT WORKS

Our ″smart beta″ approach reflects that there is a differentiated (″smart″) approach to index investing (″beta″). The fund′s index∗ follows the following systematic approach:

∗The fund′s index is the Elston Smart-Beta UK Dividend Index

KEY POINTS

- Forward-looking

- Dividend-weighted

- Monthly-income

Prospectus

Annual Report 2023

Annual Report 2022

Annual Report 2021

Annual Report 2020

Annual Report 2019

Application Form VT Munro Smart-Beta UK Fund - Individuals

Application Form VT Munro Smart-Beta UK Fund - Institutional

Key Investor Information - Class X

Latest Factsheet

Assessment of value statements are published annually for this fund - These reports are useful to give an overview of how the Fund has performed in comparison to industry comparators.

The latest net asset value per share is as follows:

| X Class Net Accumulation |

188p |

| X Class Net Income |

93p |

| |

| |

| Net Asset Value as at 12:00 on 26th April 2024. |

| |

Past performance is not necessarily an indication of future results

Questions and Queries

For frequently asked questions or further information about your holdings or this fund please:

Email the Fund Team smartbeta@valu-trac.com or call us on: 01343 880 344 and quote the fund name.

WARNING: The information on this page is presented by Valu-Trac using all reasonable skill, care and diligence and has been obtained from or is based on third party sources believed to be reliable but is not guaranteed as to its accuracy, completeness or timeliness, nor is it a complete statement or summary of any securities, markets or developments referred to. The information on this page should not be regarded by recipients as a substitute for the exercise of their own judgement.

The information on this page has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient and is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. In the absence of detailed information about you, your circumstances or your investment portfolio, the information does not in any way constitute investment advice. If you have any doubt about any of the information presented, please consult your stockbroker, accountant, bank manager or other independent financial advisor.

Value of investments can fall as well as rise and you may not get back the amount you have invested. Income from an investment may fluctuate in money terms. If the investment involves exposure to a currency other than that in which acquisitions of the investments are invited, changes in the rates of exchange may cause the value of the investment to go up or down. Past performance is not necessarily a guide to future performance.

Any opinions expressed on this page are subject to change without notice and Valu-Trac is not under any obligation to update or keep current the information contained herein. Sources for all tables and graphs herein are Valu-Trac unless otherwise indicated.

The information provided is "as is" without any express or implied warranty of any kind including warranties of merchantability, non-infringement of intellectual property, or fitness for any purpose. Because some jurisdictions prohibit the exclusion or limitation of liability for consequential or incidental damages, the above limitation may not apply to you.

Users are therefore warned not to rely exclusively on the comments or conclusions within the page but to carry out their own due diligence before making their own decisions.

Valu-Trac Investment Management Limited and its affiliated companies, employees of Valu-Trac Investment Management Limited and its affiliated companies, or individuals connected to them, may have or have had interests of long or short positions in, and may at any time make purchases and/or sales as principal or agent in, the relevant securities or related financial instruments discussed on this page.

© 2023 Valu-Trac Investment Management Limited. Authorised and regulated by the Financial Conduct Authority (UK), registration number 145168. This status can be checked with the FCA on 0800 111 6768 or on the FCA website (UK). All rights reserved. No part of this page may be reproduced or distributed in any manner without the written permission of Valu-Trac Investment Management Limited. Valu-Trac is a registered trademark.

|